Business Insurance in and around Rogue River

Calling all small business owners of Rogue River!

This small business insurance is not risky

Help Protect Your Business With State Farm.

It takes courage to start your own business, and it also takes courage to admit when you might need guidance. State Farm is here to help with your business insurance needs. With options like business continuity plans, errors and omissions liability and a surety or fidelity bond, you can feel comfortable that your small business is properly protected.

Calling all small business owners of Rogue River!

This small business insurance is not risky

Customizable Coverage For Your Business

At State Farm, apply for the great coverage you may need for your business, whether it's a florist, a sporting good store or a clock shop. Agent Dean Stirm is also a business owner and understands your needs. Not only that, but customizable insurance options is another asset that sets State Farm apart. From one small business owner to another, see if this coverage can't be beat.

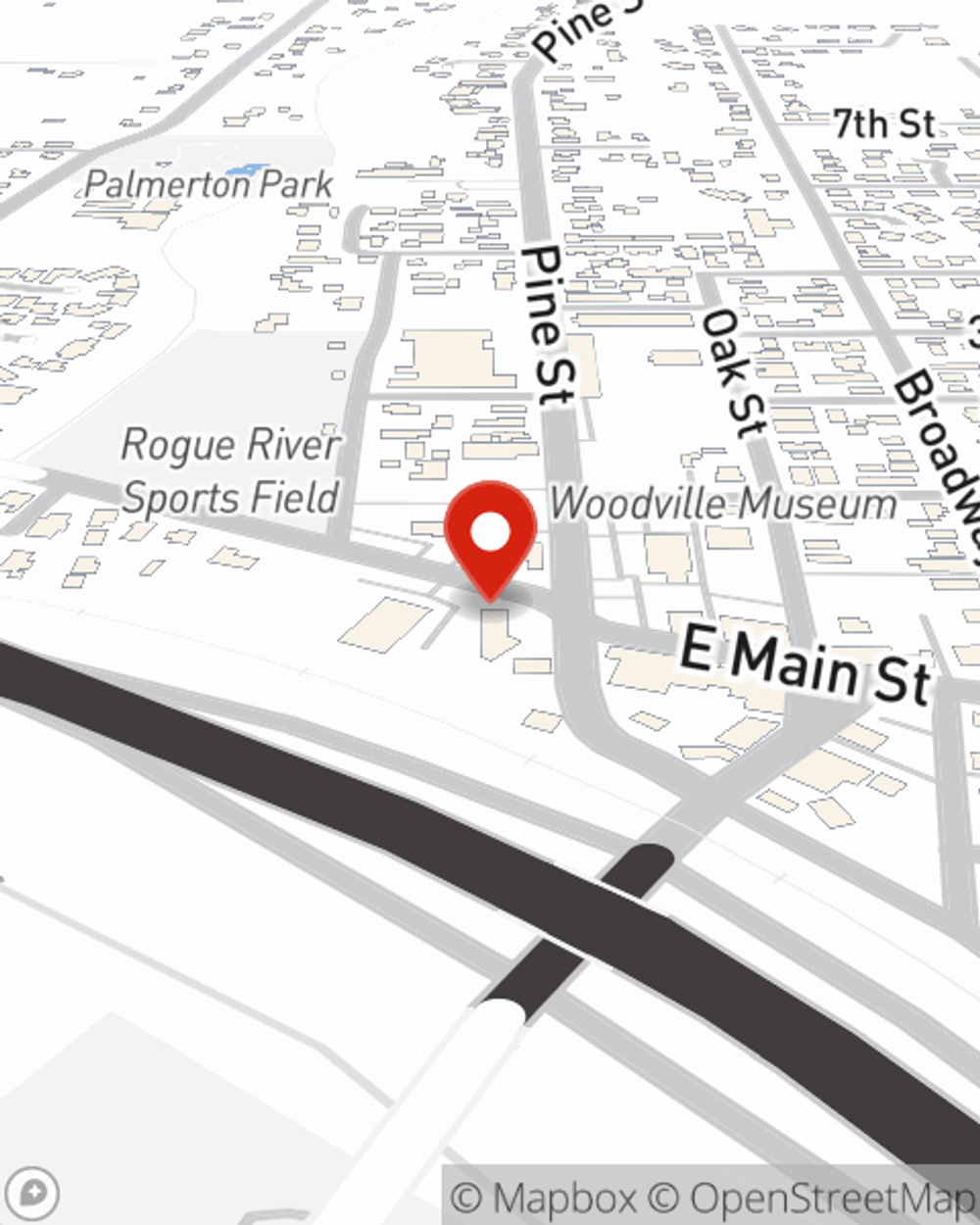

Call Dean Stirm today, and let's get down to business.

Simple Insights®

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.

Dean Stirm

State Farm® Insurance AgentSimple Insights®

Farm scheduling versus blanket coverage

Farm scheduling versus blanket coverage

When deciding between blanket coverage or scheduling, we have some tips that could help with the decision.

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.